- September 11, 2018

- Posted by: Admin

- Category:

No Comments

Strengths

- From the very year until graduation, the students have opportunities to learn from the faculty members from the School of Development Economics, NIDA, who are experienced and have expertise in economics and finance and the faculty members with expertise in engineering and technologies from the Faculty of Engineering, KMITL.

- Classes are held at both KMITL and NIDA. Shuttle buses between KMITL and NIDA campuses are provided. Students can use all the facilities, such as libraries, sport facilities, the Internet) at both KMITL and NIDA for their entire study period in the program.

- Both KMITL and NIDA have extensive partnerships with industry and universities worldwide. This provides excellent opportunities for the students to undertake internships and study abroad.

- All teaching and learning activities in the program are held in English language.

Careers

- Work in financial institutes, such as banks, financial securities firms, or insurance companies, as a quantitative analyst (or a quant), fund manager, or financial risk manager

- Work as a financial advisor

- Work in the FinTech industry

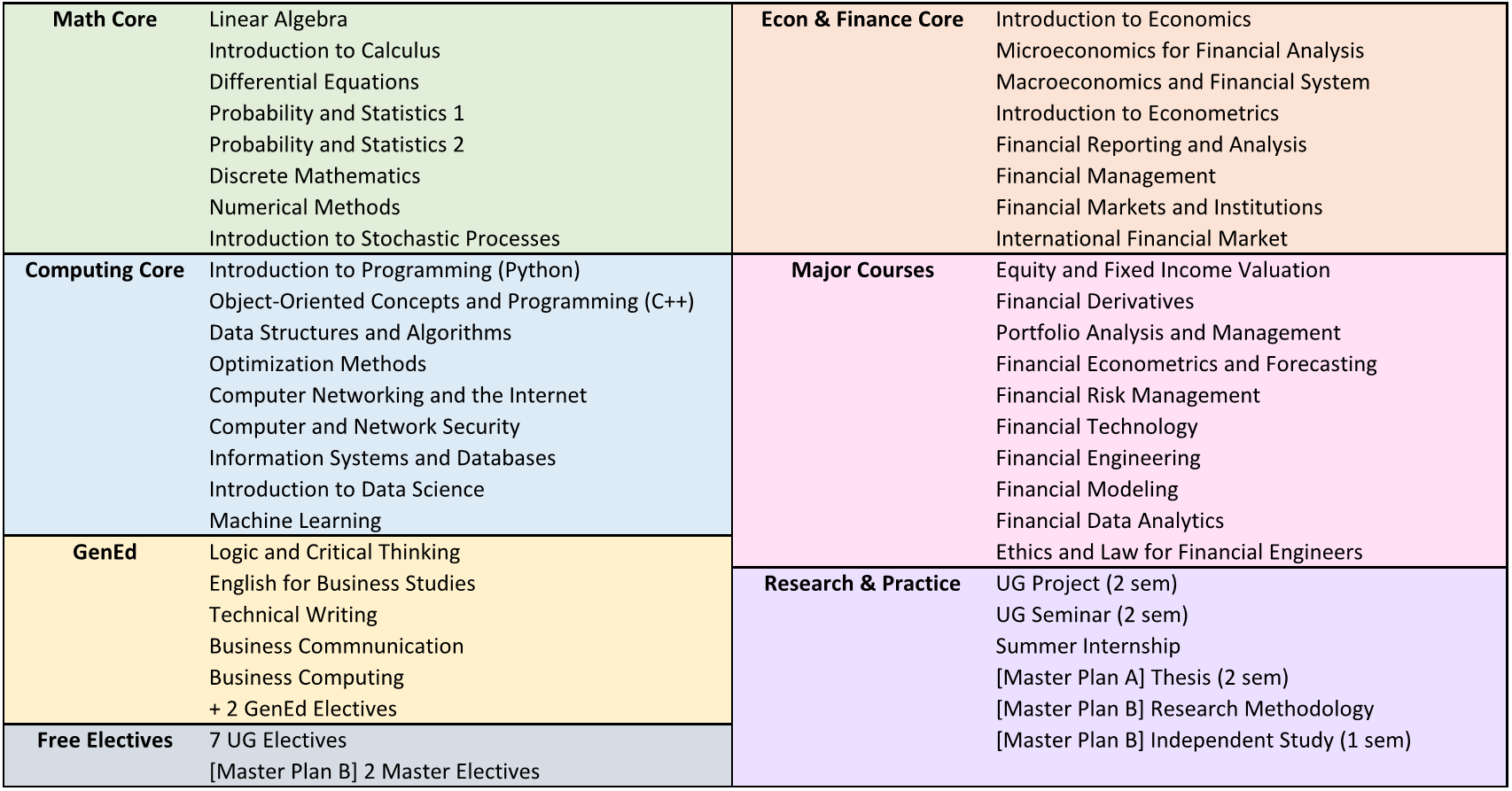

Program Structure

Study Plan

| Semester 1 | Semester 2 | |

| Year 1 |

|

|

| Year 2 |

|

|

| Year 3 |

|

|

| Summer Internships | ||

| Year 4 |

|

|

| Graduate with B.Eng. in Financial Engineering | ||

| Year 5 |

|

|

| Graduate with M.S. in Financial Engineering | ||

Download

- Program factsheet – Thai, English

- Program specification

- B.Eng. in Financial Engineering